Now living a financially-stable life, the couple founders of Parent Portfolio, a website that serves families to make progress with their money and helps the younger generations become financially wise, teaches their kids lessons towards a successful life.

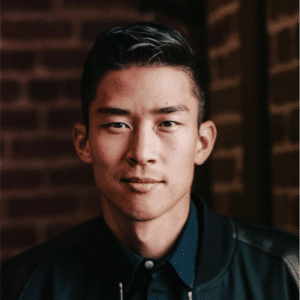

Born to a financially precarious environment, Jonathan Sanchez was reared with a thrifty outlook by his single mom, which made him yearn for financial stability.

Sharing the same financial sentiments, or even more, with his mother made him believe that if he would be able to get a degree and land a well-paid career, he would be freed from all his money issues.

However, he then realized that his mindset was not as easy as it seemed as, despite achieving a profession together with his wife, Jacqueline Sanchez, their incomes were just enough for their family’s essential needs.

The Sanchez couple’s life turned 360 degrees after realizing a $1 million net asset by being economical, able to save, doing part-time jobs, and venturing into real estate.

At 37, Jonathan realized his long-dreamed financial independence and stability. In 2020, he decided to share this with other people by co-founding the Parent Portfolio with his wife.

Aside from helping other people, the couple is also bound in educating their kids with the following five valuable tips they shared on CNBC:

- Always rethink one-time purchases. Living within the means and spending efficiently only on what is needed;

- Budgeting gives you more freedom. Planning your budget is financial freedom which benefits you over and over again;

- Don’t let social media influence your spending. Do not be pressured by what you see in the public network and discipline yourself in using gadgets;

- Know where the money comes in, and where it goes out. The couple exposes their children to their income resources, introduces them to the “real world” and even shows diagrams on how to deal with the people and offices they transact with; and,

- Start saving early, and don’t expect to get rich overnight. Learning from the fable of The Tortoise and The Hare, the couple teaches their children of being wise and patient.

“For now, your mother and I are responsible for providing for your needs and wants. A bank is a safe place to put your money because it allows the funds to grow over time. And when you’re old enough, you can use that money for your own goals,” Jonathan tells his children.