The entrepreneurial and innovative enterprises that will drive the recovery from the Covid-19 pandemic are the small businesses, but the micro-enterprise all over the world face the same issue: they frequently struggle to obtain the finance they require to expand.

Funding Societies (which goes by Modalku in Indonesia) wanted to empower small and medium-sized enterprises (SMEs) in Southeast Asia. It offers a range of loans and credit products to small businesses in the region, with advances starting at as little as $500 but can be as large as $1.5 million.

The company has recently raised $144 million in a Series C+ round headed by Softbank’s Vision Fund 2, as well as $150 million in additional lending lines from financial institutions in Europe, the United States, and Asia.

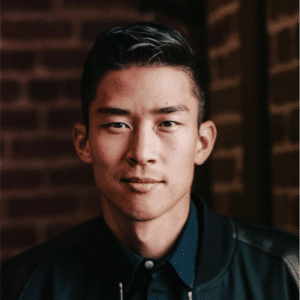

In 2015, Kelvin Teo and Reynold Wijaya founded the company in Singapore, and has now financed more than $2.1 billion to businesses across the region, with over 5 million loans disbursed.

According to a research conducted with Asian Development Bank methodology, the businesses it has backed have so far contributed $3.6 billion to the region’s GDP and produced up to 350,000 employment. It also has already expanded into Thailand, Malaysia, Vietnam and Indonesia.

Banks in these regions have never shown much interest in the SME sector. Small and medium-sized businesses (SMEs) fall in the center, requiring personalized service that banks do not find profitable due to the size of the advances often requested.

“A common misconception is that we compete with banks,” Teo said in an interview. “The reality is we compete with savings, friends and families, and business owners’ personal credit cards – there is a huge unsecured financing gap.”

The new funding will help enable further expansion, as the company plans to launch in the Philippines next. The funds will also be used to further improve the platform, which has matured into a neobank since its original launch. Teo believes that supply chain finance, for example, has a lot of potential.